It's About Time. Literally.

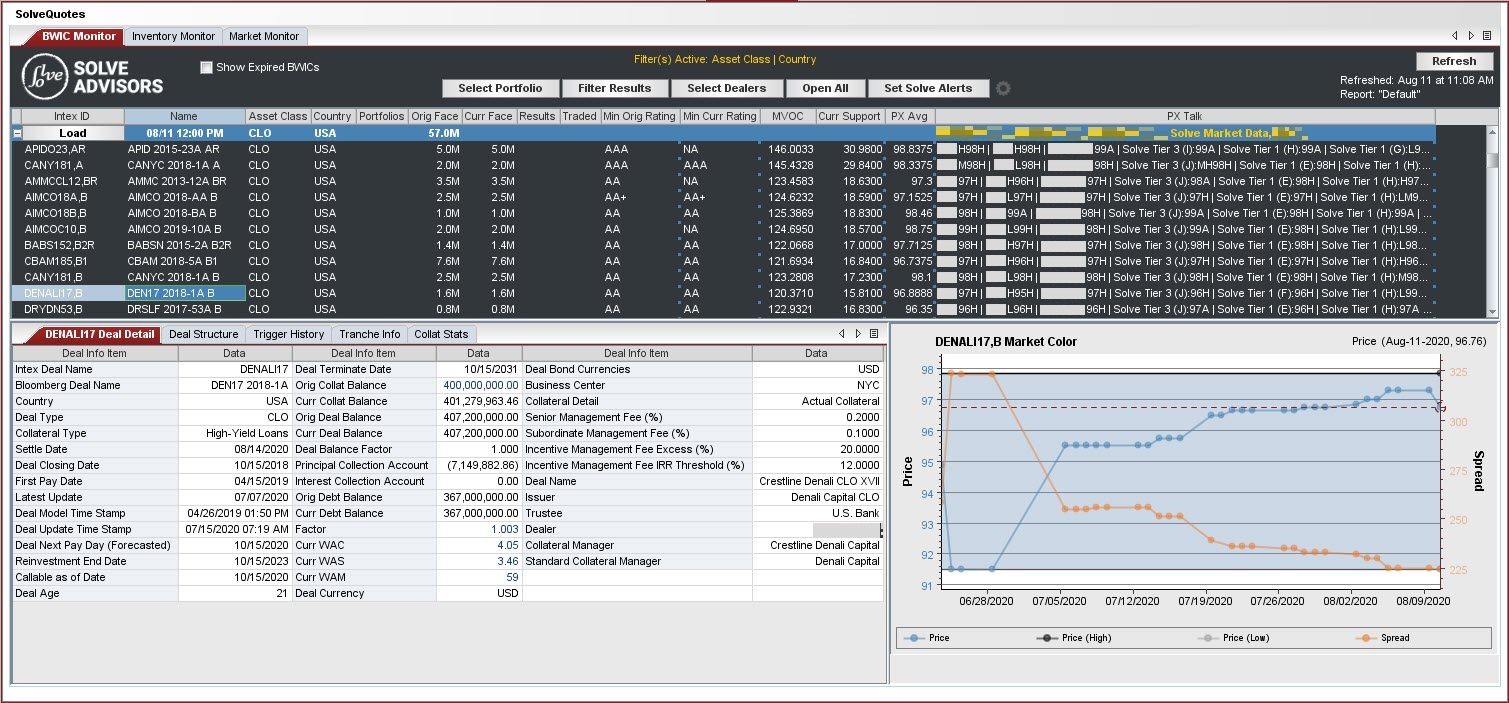

SOLVE’s industry-leading BWIC, Dealer Inventory, and Market Color platform is integrated into INTEX, so you have the complete picture of the Structured Products markets in just one screen.

See the difference. Sign up for a free 30-day trial:

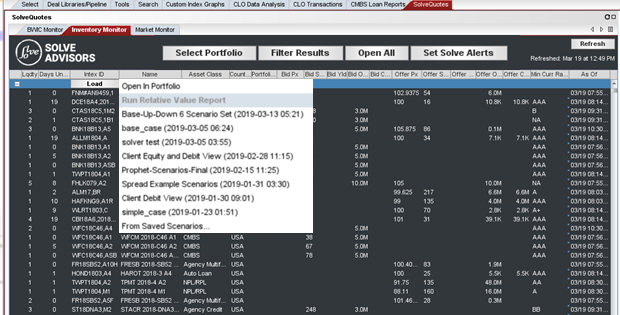

- BWICs and Dealer Inventory with customization and filtering, including Tranche Minimum Rating, MVOC based on latest EOD pricing, Attachment Point, and more.

- Single-click custom scenario analysis on outstanding BWIC and Dealer Inventories.

- Integration with the Solve Advisors alert system, so you don't miss an opportunity.

- Real-time and historical market color across the deal and within INTEX Portfolios.

- Full integration with CLO Data Analysis.

- INTEXlink Excel Add-in.

About SOLVE

Powered by the industry’s most sophisticated and flexible technology, SOLVE allows you to collect more data and color when and how you need it.

The Solve platform utilizes natural language processing and machine learning to extract all bids, offers, and other price talks within clients' emails and overlays it with trade color from contributors, helping provide price transparency and tools that make your day-to-day a lot more efficient.

Access

Coverage on 4MM+ securities across five asset classes (Structured Products, Corporates, CDS, Bank Loans, Municipals).

Accuracy

Our technology doesn’t depend on templates; it can pick up pricing from regular interactions, so data isn’t dropped or duped.

Insight

Real-time and historical pricing, streamlined BWICs and Dealer Inventories, relative value and liquidity analysis so you know the true depth of the market.

Flexible Integration and Security

Partner integrations with INTEX, Moody’s Analytics, Trepp and Reorg, plus Excel add-ins and an option for on-premises installations provide the flexibility you need but rarely find.